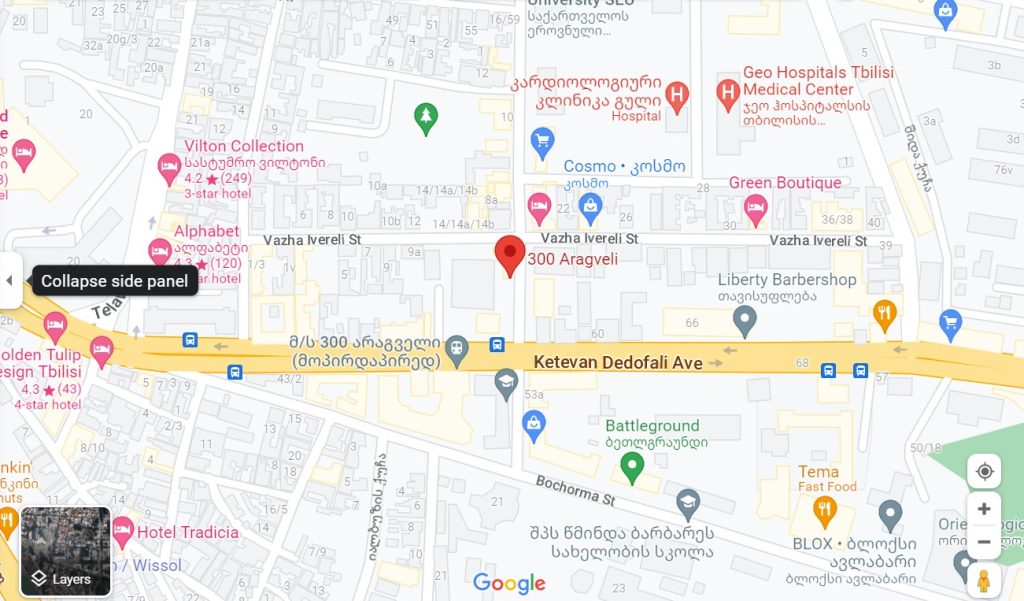

Ketevan Dedopali Avenue, 24

- +995 595 313 001

Renovated, modern new office for rent in Tbilisi

We are offering a newly renovated, modern office in the center of Tbilisi. The office space area totals 188.4 square meters on the second floor, plus 13.75 square meters of closed parking on the -1 floor.

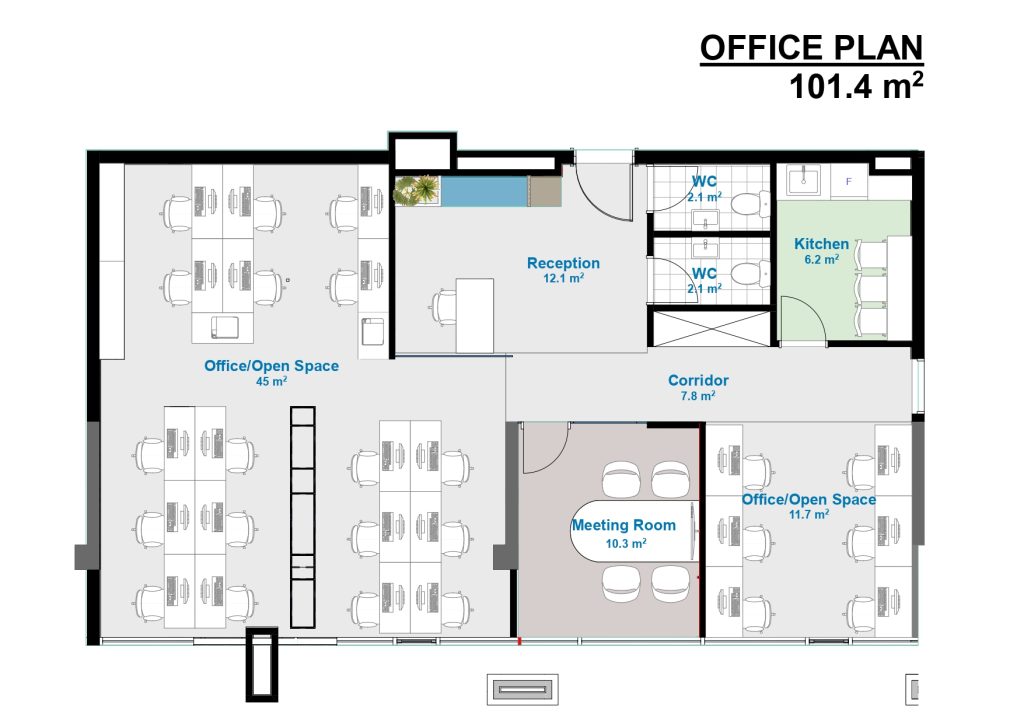

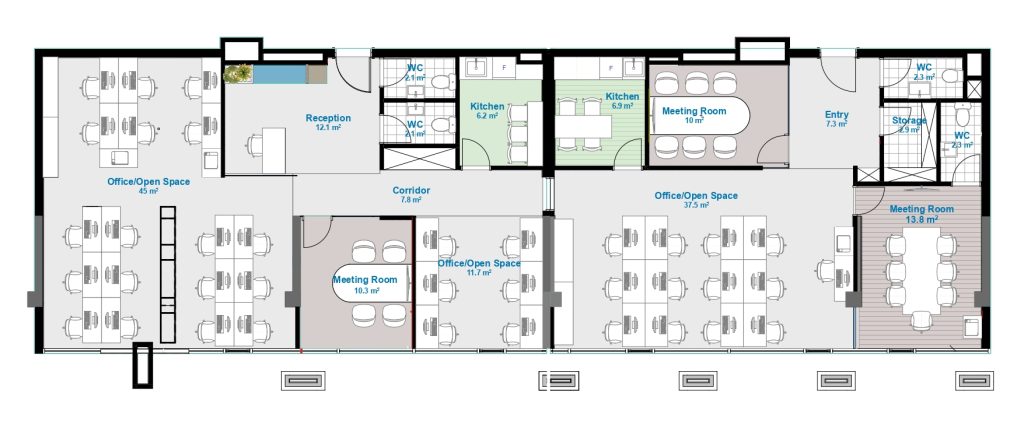

The 188.4 square meter office space consists of two separate offices next to each other, separated by a central door. Office #1 (101.4 square meters) and Office #2 (87 square meters) are registered under different cadastral codes. Therefore, they can be used as one common space or separately as two unconnected offices.

We will consider renting out Office #1 and Office #2 separately or together. However, we prefer renting the entire office space and the parking space as one.

Description of the office(s) available for rent in Tbilisi, Georgia

The offices are located on the second floor of a newly built multifunction building with a beautiful exterior and interior design. Right next to 300 Aragveli metro station.

Each office has one kitchen, two bathrooms, one meeting room, and common spaces for work. In addition, Office #1 has a reception area, and Office #2 has an office for a manager as well as one separate closed room for a team of six people.

Detailed characteristics of both offices are presented below:

The 188.4 square meter office space consists of two separate offices next to each other, separated by a central door. Office #1 (101.4 square meters) and Office #2 (87 square meters) are registered under different cadastral codes. Therefore, they can be used as one common space or separately as two unconnected offices.

We will consider renting out Office #1 and Office #2 separately or together. However, we prefer renting the entire office space and the parking space as one.

100 (101.4) square meter commercial space for rent in Tbilisi (Office #1)

- A reception

- One meeting room (accommodates 4-5 people)

- One big open working space (for up to 18 people

- One small open working space (for up to 6 people)

- Two bathrooms

- One kitchen (accommodates 4-5 people at once)

Rent office for twenty employees in Tbilisi (Office #2)

- One big common working space (for up to 13 people)

- One small, closed separate room (accommodates up to 6 people and can also be used as a meeting room)

- One separate room that can be used as an office for a manager, a separate room for employees, or a meeting room (accommodates up to 6-7 people)

A Spacious Office for rent in Tbilisi, Georgia – Accommodates up to 44 People, nearly 200 square meters of space

Even though both Office #1 and Office #2 can be rented and used independently (as they are separate properties), it is most convenient to use both offices together as one space. We prefer renting the whole property to one reliable client (this factor will also influence any lowering of the rent price). It is more practical to use both offices as one united space with a reception, office for manager(s), a meeting room, closed and open working spaces, four bathrooms, two kitchens and some spaces for leisure.

The entire office accommodates up to 44 full-time staff, and each employee will have ample space to work. The width of the working tables is 1 meter and 15 centimeters.

You can allocate the space to less than 44 people to give them a bigger space, use the closed separate rooms as additional meeting rooms or as rooms for leisure, based on your preferences.

The office’s location is in the Avlabari district of Tbilisi, Georgia, literally next to 300 Aragveli Metro station (around thirty meters from the metro station), right on Queen Ketevan Tsamebuli Avenue. A central, quiet, comfortable and easily accessible newly reconstructed area of Tbilisi.

Notably, Ketevan Tsamebuli Avenue was newly reconstructed and renovated by the government of Georgia so that the area now has a modern, developed style and is easily and conveniently accessible. Outdoor parking spots and places for delicious lunches during break times can be found in the area. Moreover, one closed parking spot will be at your disposal if you rent the office space.

IT and Other Service Company Office Space for Rent in Tbilisi – A Perfect Match for Your Modern Business Needs

The office is suitable for service companies like IT software development companies, agencies, law companies, export/import companies, and more. The well-designed modern interior of the office provides a comfortable working environment; it also gives you the possibility to have meetings with clients and guests. Also, it is easily accessible, especially for public transport users.

Modern, renovated office for rent in Tbilisi – Discover Your Next Business Location

We offer you a newly renovated, partly furnished, well-designed and comfortable office for rent in the center of Tbilisi, Georgia.

The office is brand new, has never been inhabited, was designed by famous interior designers, is located in a very convenient area (next to a metro station in a central location) and can accommodate up to 44 full-time employees simultaneously.

Additionally, there is a meeting room, an office for a manager, two kitchens, four bathrooms and one reception area.

The width of the tables in the office is designed to be 1.15 meters, and there will be enough space for all employees comfortably, even if you exploit the office to the highest possible extent (44 people).

The office is on the second floor in a multifunction newly built building, which faces Ketevan Tsamebuli Avenue.

Schedule Call/Meeting

Take the next step in growing your business.

Contact us at [email protected] or Whatsapp, Viber, or Telegram for more information and to schedule a viewing.